Written by: Mahmoud Demerdash

Date: 2024-01-16

Energy Dynamics & The Future

Energy Dynamics & The Future:

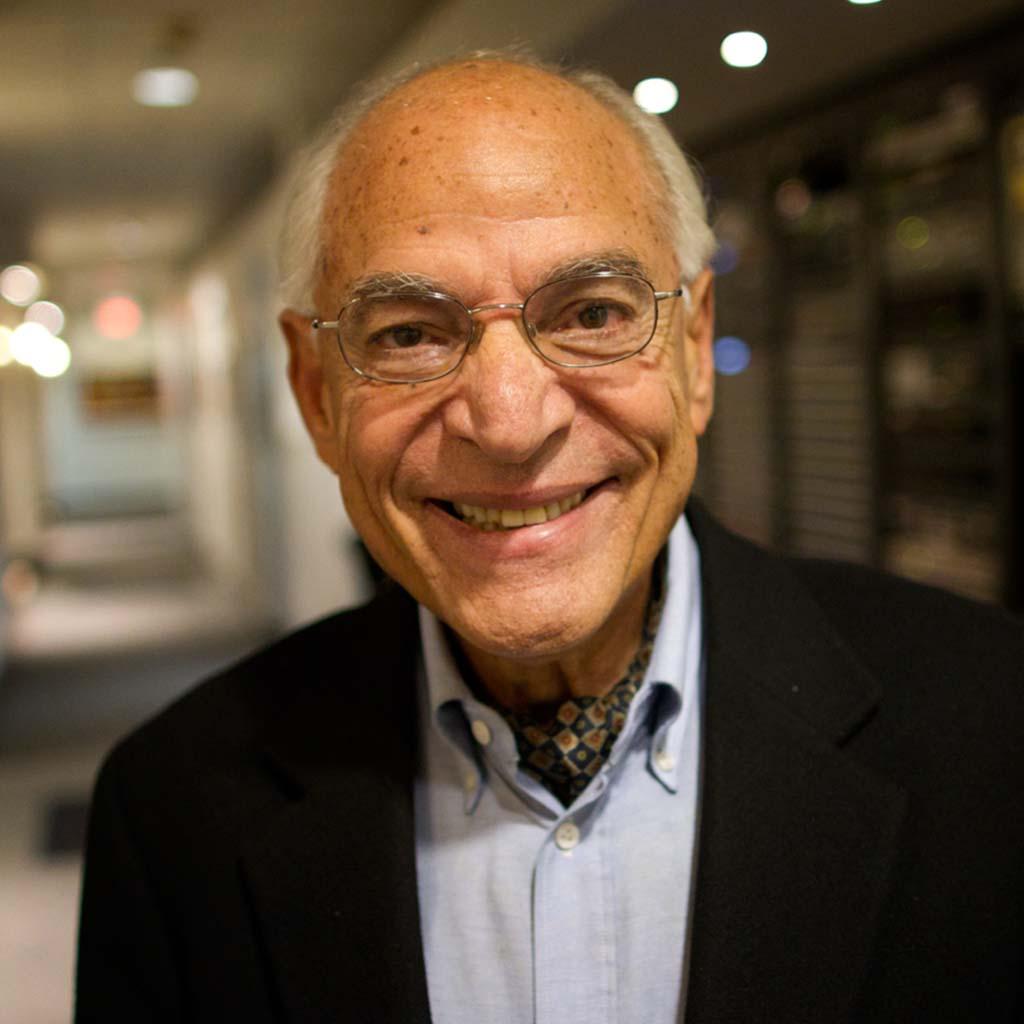

An Interview with Hussein El-Ghazzawy

Hussein El-Ghazzawy is a prominent figure in the global energy and industry landscape whose illustrious career spans over 35 years globally. Renowned for his visionary leadership, he has spearheaded groundbreaking megaprojects, advised governments and multinational corporations, and chaired esteemed technical panels and industry award juries. El-Ghazzawy's expertise as a key opinion leader has earned him a prominent place as a frequent media feature and keynote speaker at prestigious energy and economic forums worldwide.

He Magazine had the privilege of engaging in an exclusive interview with El-Ghazzawy, delving into the most pressing modern topics surrounding energy. The interview encompassed critical discussions on the impact of current conflicts on the oil trade, the burgeoning advancements in clean energy, Egypt's remarkable strides in gas development, and the accelerating landscape of electric vehicles. The energy sherpa’s insights provided invaluable perspectives, illuminating the intricate interplay between geopolitical dynamics, technological innovation, and sustainable energy transitions.

Ongoing global conflicts have significantly destabilized international stability, none more impactful than the war between Ukraine and Russia that commenced in February 2022. This conflict substantially influenced the world's economy, particularly in Europe, where heavy reliance on Russian gas became evident as several pipelines powered the continent's infrastructure. Russia, once a primary gas supplier to Europe, witnessed a marked shift in the last two years as European nations sought alternative sources, diversifying their gas procurement strategies amidst geopolitical turbulence. El-Ghazzawy states, “America has notably emerged as the primary beneficiary, capitalizing on the shifting balance of influence. It has taken on the role as a dependable gas importer to Europe, yielding significant gains as the region seeks more diverse and reliable sources post-conflict.” He also noted, “There has been a notable surge in sales from countries like Algeria, Egypt, and Qatar.”

The far-reaching influence of conflicts on the oil trade is a compelling observation, highlighting the intricate connections between geopolitical events and the depth of globalization within the world economy. It underscores the profound interdependence and the extensive reach of global interactions across various sectors. This observation gains further significance as another conflict is poised to exert its influence on global trade. The Israel-Gaza war, initiated in October 2023, presents an imminent threat, raising concerns about potential disruptions and fluctuations in the oil market. When asked on his opinion regarding the conflict's influence on the energy trade, El-Ghazzawy said, “While the conflict's immediate impact on gas prices might seem less pronounced, its effect on transportation is considerably more significant. However, should the conflict escalate and reach the crucial chokepoint of the Strait of Hormuz, the potential for a notable global supply disruption becomes a tangible concern, likely exerting substantial influence on petrol prices worldwide.” The situation is swiftly commencing as the Houthis in Yemen have initiated actions against Israeli-affiliated gas ships navigating the Red Sea by seizing them. This disruption has led to the diversion of numerous trade vessels, causing ripples across maritime routes. Consequently, in coordination with other nations, the United States has initiated an operation aimed at safeguarding ships entering the strategically vital Strait of Hormuz.

Another critical aspect discussed amidst the conflict is the presence of gas wells situated in the waters off Gaza, adjacent to the Mediterranean Sea, and the potential developments stemming from this resource. The exploration and utilization of these gas reserves in Gaza's maritime territory represent a significant opportunity that could reshape the region's energy landscape and play a pivotal role in the area's socio-economic development. El-Ghazzawy indicates, “The existence of oil wells along the Gaza coast holds the promise of substantial benefits for the region by offering a pathway to decrease its dependence on energy supplies from neighboring Egypt and Israel. This potential resource could serve as a catalyst for greater energy independence and economic autonomy for Gaza, potentially transforming its energy landscape and reducing reliance on external sources.”

The intense brutality of the conflict and the subsequent displacement and suffering endured by the Palestinian people, spanning not just Gaza but also the West Bank, have sparked widespread condemnation globally. Amidst these discussions, a recurring question gaining traction on social media revolves around the actions taken by the MENA countries concerning the oil trade, akin to the 1973 embargo. Many individuals are pondering why similar measures have not been implemented by these nations in response to the current crisis, drawing comparisons to the past use of oil as a geopolitical lever during times of conflict in the region. El-Ghazzawy provided immense details as to why this hasn’t occurred. He stated, “In 1973, Arab states had a commanding 70% market share, allowing them to significantly impact global gas supply by restricting it to the West. However, their current market presence stands at just 30%. As a result, withholding gas today wouldn't wield the same influential outcomes as it did back then, given the substantially reduced share in the global gas market.” The market has widely diversified since then, and other measures have been undertaken as a result of 1973; as El-Ghazzawy said, “The United States, alongside several other countries, boasts a strategic reserve designed to navigate market turbulence, as notably showcased during the Ukraine-Russia conflict. Moreover, many developed nations possess substantial gas reserves, ensuring their self-sufficiency for up to three months, offering a buffer against supply disruptions or geopolitical tensions impacting the global gas trade.” However, a 30% market share remains significant and could potentially wield some influence, albeit unlikely to replicate the magnitude of its past impact. El-Ghazzawy explains, "Holding back gas supplies would probably lead to a price hike, echoing the effects seen during the Ukraine-Russia conflict, ultimately impacting the average consumer.”

Another crucial aspect of this conflict involves the overall development of the MENA region and the intricate balance required to navigate the current situation while sustaining its upward trajectory. El-Ghazzawy informs, “Arab countries are currently engaged in several substantial projects and initiatives, and any such action to withhold gas could disrupt these critical endeavors. Instead, they have pursued more effective strategies, such as engaging with the UN, to contribute to the improvement of the situation in Gaza.”

The undeniable advancement of the MENA region stands prominently evident, with a spotlight on mega projects and significant industrial advancements taking center stage. Egypt has been a critical participant in this transformation, channeling substantial investments to drive extensive infrastructural changes and foster robust growth. Notably, the Egyptian gas sector has witnessed significant expansion and evolution since 2014, aligning with the nation's broader infrastructure development and economic progress endeavors. El-Ghazzawy elaborates, "In recent years, Egyptian Petroleum has made remarkable progress, surpassing both companies and nations in its advancements within the industry. This success owes itself to a combination of technological innovations and strategic initiatives our President and government spearheaded. Notably, between July 2014 and July 2023, Egypt achieved a significant milestone, discovering over 428 oil wells, a testament to the nation's proactive approach and advancements.”

Despite the discoveries and increased oil harvesting, there remains a persistent trend of rising gas prices, prompting widespread concern regarding this ongoing issue. El-Ghazzawy explains, “The considerable surge in China's industrial sector, spurred by the necessity to offset losses incurred during the pandemic, stands as a driving force poised to elevate global prices notably. This escalation is anticipated as China intensifies its gas purchases within the market, exerting substantial pressure on global pricing dynamics.” he further elaborates, “Establishing a price that strikes a fair balance between supplier and consumer is pivotal for maintaining a sustainable ecosystem. It's a reality that higher-octane vehicle owners will bear the cost implications. There's a global endeavor to reduce our carbon footprint, with Egypt aiming to phase out gas consumption by 2050. This shift will likely lead to price increases in the foreseeable future.”

Around the globe, a significant shift towards clean energy sources is underway, driven by the imperative to transition away from environmentally harmful energy sources like gas. Egypt stands at the forefront of this movement, making substantial strides in developing clean energy infrastructure. Projects like the Benban Solar Park and the Zafarana Wind Farm showcase Egypt's commitment to renewable energy over the past decade. The continued dedication to these initiatives leaves many Egyptians curious about how their country is emerging as a prominent hub for this endeavor. El-Ghazzawy believes, “Egypt's vast open spaces offer abundant opportunities for extensive development of sustainable, clean energy sources. Moreover, clean energy has witnessed significant cost-effectiveness compared to gas, marking a notable shift in the energy landscape. It's recognized that higher investments yield higher outputs, highlighting the potential for substantial returns in clean energy development.” Egypt’s vast open spaces could be significant in clean energy production, especially from an export standpoint. El-Ghazzawy indicates, “Europe's heavy reliance on power, particularly evident during winters, is steering the region towards a quest for more cost-effective alternatives in the future. The global surge in clean energy adoption this year reflects a significant uptick. Egypt stands poised to tap into a substantial customer base, especially considering this growing global trend towards cleaner energy sources.”

Amidst the global green initiative, Electric Vehicles (EVs) have witnessed a tremendous surge in popularity. From Tesla's pioneering efforts to numerous mainstream manufacturers actively developing EVs and enhancing their technological capabilities, the traction for these vehicles has been substantial. With EVs rapidly becoming mainstream, the shift towards their eventual dominance over gas-powered vehicles seems more a question of 'when' than 'if.' El-Ghazzawy indicated, “In the past year, global sales of Electric Vehicles (EVs) reached 10 million units, but this year has witnessed a significant surge, escalating to 14 million units sold. This growth constitutes roughly 18% of all cars sold worldwide, underscoring the remarkable ascent and growing market share of EVs in the automotive industry.” he further states, “China currently holds a dominant position in the Electric Vehicle (EV) market and is steadfastly progressing towards its ambitious goal for 2030. The nation aims to power 40% of its vehicles through electric means, showcasing a strong commitment to transitioning to EVs on a large scale.”

The global market is gearing up for a significant shift towards electric vehicles, evident in its expanding size and increasing momentum. However, the question remains, what does this shift look like in Egypt? El-Ghazzawy informs, “Currently, Egypt's Electric Vehicle (EV) market is relatively small, boasting approximately 5,000 electric vehicles in use. However, there's a notable push from the government to implement measures to incentivize EV purchases. These initiatives signal a promising trajectory toward a more significant adoption of electric vehicles in the country's foreseeable future.”. The government's efforts extend beyond incentivizing Egyptians to purchase Electric Vehicles (EVs); they're also eyeing entry into the EV market through domestic production. El-Ghazzawy explains, “Egypt is witnessing the emergence of Electric Vehicle (EV) battery factories, a development bolstered by the government's proactive measures. These efforts include forging partnerships with African nations to secure a reliable supply chain for these facilities. Notably, Egypt's robust ties with the Democratic Republic of Congo (DRC), the primary supplier of cobalt, solidify its position as a crucial player in sourcing essential materials for EV battery production.” As Egypt stands on the brink of diving into the Electric Vehicle (EV) market, El-Ghazzawy concludes, “I highly encourage the younger generation to explore establishing Electric Vehicle (EV) stations across Egypt. This endeavor presents not just a promising business opportunity but also contributes significantly to enhancing the convenience and accessibility of EV charging infrastructure for owners throughout the region.” Establishing Electric Vehicle (EV) stations across Egypt is crucial as it supports the country's transition towards sustainable transportation, reduces reliance on fossil fuels, and mitigates environmental impact. This infrastructure development ensures convenient access to charging points, encourages broader adoption of electric vehicles, addresses range concerns and presents economic opportunities for entrepreneurs and job creation.

Interview By: Amr Selim